Car Loan Approval Malaysia

Get a pre-approved loan. You may apply for a car loan by visiting any bank of your choice.

How To Get Your Car Loan Approved Here Are 5 Things That Affect Your Chances Wapcar

Ideally you should opt for a shorter loan term if the monthly repayment is within your budget.

. In 1949 the loan tenure for a VW Beetle was 12 months with an interest rate of 9 per annum. Depending on the type of loan undertaken you may save money with early settlement. Malaysia car loan calculator to calculate monthly loan repayments.

Payday bank loan corporations frequently offer the perfect remedy to emergency instances. Getting pre-approved loans are useful to know how much you can afford. Generally it is a good idea to make comparisons between.

Below is a summarised diagram of a typical car loan application process in Malaysia. Compare and calculate your monthly repayments on Loanstreets car loan calculator and save more than RM100 every month. Banks are willing to offer expats a margin of financing up to 90 of the total amount.

Once the verification process is completed the loan officer might call your employer to determine that you are providing accurate information and that you have a sound income. In Malaysia today car loan tenures are usually of 57 or even 9 years with interest rates hovering around 3 per annum calculated on principal. You will receive your loan in cash within shortest period after loan approved.

A car loan requires documentation regarding the car as it is the guarantee that is used as the basis for the loan. Our professional consultant would customize you a best fit package to solve your finance problem. The advertised rates range from 23 pa to 425 pa.

Typically many of the banks. Loans enable you to hold on to your cash in hand by charging you an interest over a certain period of time. You may still be eligible for a car loan even if you already have another loan.

New cars are notoriously easy to get loans for if youre in good credit standing and the interest rates are competitive. Depending on bank and car typemanufacturer. CIMB auto loansalso referred to as hire purchaseprovides expats and foreigners with businesses in Malaysia up to 75 financing.

How Long Does Car Loan Approval Take Malaysia. Compare Car Loans in Malaysia 2022. A car loan in Malaysia is a type of loan that is taken by an individual for the sole reason of buying a car.

His debt service ratio would be calculated as. Then you will be informed in about 3 days whether the loan is approved. For car financing ambank hire purchase is the no 1 car financier in malaysia with fast loan approval.

Aishah told The Malaysian Reserve TMR that earlier the assessments took three to five days but now they can take a. The car loan application process. Provide us your Financial Documents.

Find a competitive interest rate for your hire-purchase from 18 banks in Malaysia. If its RM55000 an approved loan is RM55000. If you are loan is approved the bank will inform the salesman and the amount is.

Procedure To Appy Loan To Buy A Car. - If its RM65000 - an approved loan is RM59900. Shopping for a car loan for your new or used car.

By taking up this loan this individual is tied down to a formal written agreement where the borrower car buyer is indebted to pay the loan amount plus interest to the lender banks financial agents etc over a specified period of time. For example to buy a car with a net worth of RM59993 the officer has a maximum loan eligibility of. With the exception of boat or bike loans the loan amount should be rounded to the lower hundred ringgit amount.

Personal Loan RM1000 Housing Loan RM2500 and Car Loan RM500 Total monthly commitment. Car Loan Approval Process Malaysia Very best Payday Loan Providers 1 Hour Hard cash Innovations In these tricky financial instances numerous individuals come across on their own quick of hard cash and in will need of an speedy personal loan. Car loan or financial service providers include banks and.

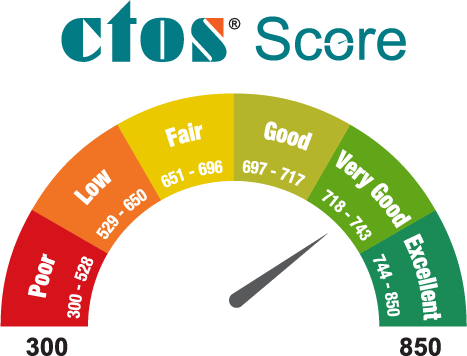

Established in 1990 CTOS is Malaysias leading Credit Reporting Agency CRA under the ambit of the Credit Reporting Agencies Act 2010. Generate car loan estimates tables and charts and save as PDF file. Proceed with Financial Assessment Test.

Just visit a couple of banks and enquire about the interest rate and amount of loan that you are able to get based on your credit score. In Malaysia car loan interest rates differ based on several criteria which notably include the make and model of the car the age of the car new or second-hand the financial standing of the borrower the loan amount the repayment period as well as the entity providing the loan. An approval of loan amount can be performed within a short period of time of two.

In Malaysia car loan tenures can take up to 5 7 or even 9 years. Currently has 3 loans. However you will find many banks do not disclose the general range of interest rates as this varies.

RM4000 RM7000 5714. Our huge cash flow can support up to. Be sure to take along all necessary documents which may differ from bank to bank to help speed up the application process.

The eligibility requirements for most car loans in malaysia are quite standard. Firstly we help to verify your proof of income documents and advise on how to structure your other income documents to increase your chance of getting the financing for the car youve always wanted. 37 rows Shariah-compliant car loan package from Maybank based on the principle of Ijarah Thumma Al-Bai.

The New Car Loan. Here is the procedure and steps or flow when you buy a new car in Malaysia. To ensure you qualify for a car loan you have to be sure that you provide all the necessary documents for your application.

Say if you want to buy a car worth RM90000 then you should have at least RM9000 and the bank settles the balance. With an income of RM7000 monthly and a monthly commitment of RM4000 Matthew has a debt ratio of 5714. Once the application and documents are submitted it is up to the bank to decide on the approval of your car loan.

We are rated top among the licensed loan company in malaysia that offer lowest interest and quicky approval for your loan. Duration of Loan approval. 1 Buyer choose model 2 Contact car seller arrange for appoinment 3 Ready all required documents 4 Appointment with consultant at your door step 5 Documents submitted for loan processing 1 2 working days.

A Guide To Car Loans Interest Rates In Malaysia

Car Loan Eligibility Calculator Ctos Malaysia S Leading Credit Reporting Agency

How To Get Your Car Loan Approved Here Are 5 Things That Affect Your Chances Wapcar

0 Response to "Car Loan Approval Malaysia"

Post a Comment