Which of the Following Best Describes Business Interruption Insurance

It differs from property insurance in that a property insurance policy only. Business interruption insurance is a type of insurance that covers you and your business from the loss of trade and income following a disaster.

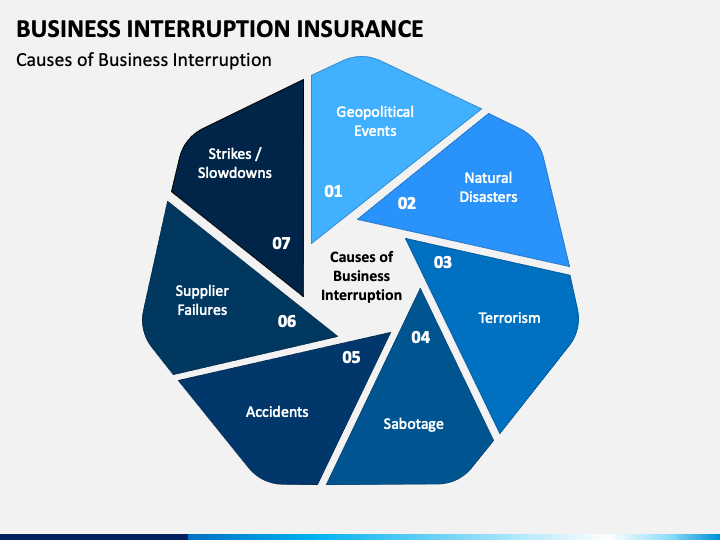

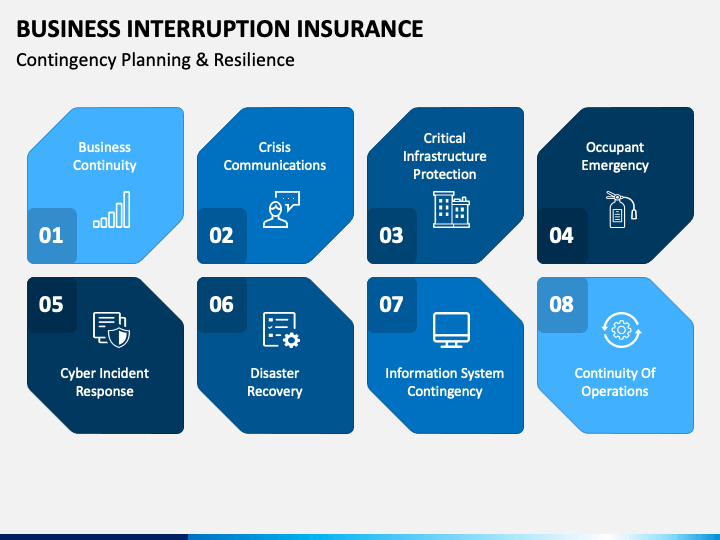

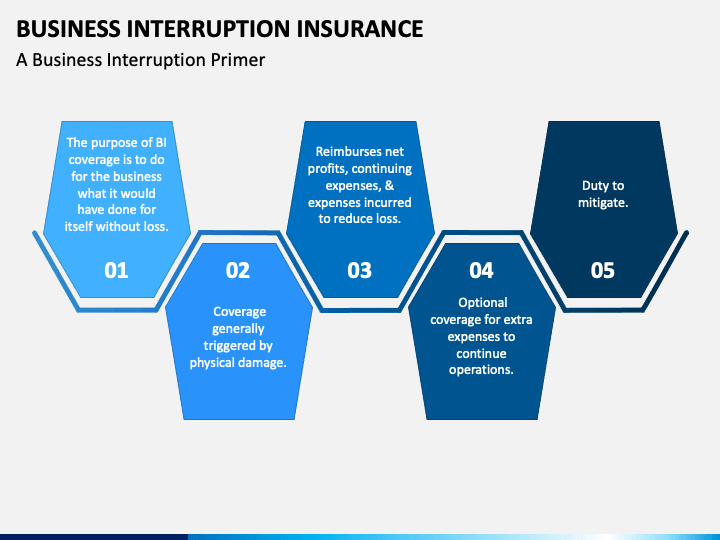

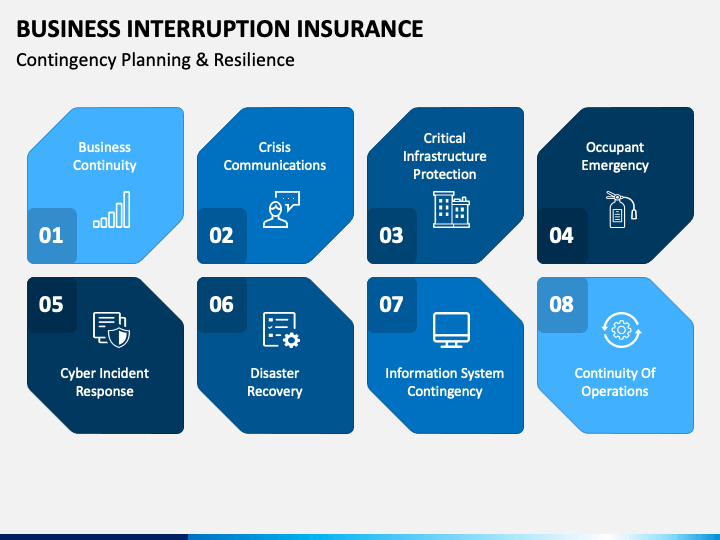

Business Interruption Insurance Powerpoint Template Ppt Slides Sketchbubble

Insurance covers ur companys legal responsibility for the harm it may cause to others as a result of what you and your employees do or fail to do.

. Business Interruption Insurance is optional coverage that may be purchased as part of a comprehensive multi-peril commercial policy. The standard cover normally responds to business interruption losses consequent upon damage to property that is insured in terms of the assets policy. Aviva Business Interruption Calculator Indemnity Period Question Set.

Business interruption insurance is designed to compensate a business for the financial impact of an interruption or interference as a result of physical damage to the insured property or due to external events such as damage at a key customer or suppliers property. Business Interruption Insurance protects the continuity of your business during or following. Which of the following best describes the Valued Business Interruption endorsement of a Boiler Machinery policy.

Business Interruption BI insurance is an essential form of cover intended to protect a business in the event of an interruption of the business following damage to property by an insured event. Lost Business income that is covered includes. Business interruption coverage which also is known as business income coverage is the most common of several so-called time element coverages designed to respond to a disruption of business activities.

B For as long as the business results are affected by the interruption subject to 100 co-insurance. Contingent losses are those stemming from damage to. Which of the following best describes the entire building you occupy ie not just the space within the building you use.

Harm may involve bodily injury or property damage due to defective. The correct option is II. Check your policy.

The need for setting aside reserves as a provision for potential losses in the. C Same as B above except 80 co-insurance. The correct option is III.

Key person insurance is intended to offset the loss to a business when a top-selling salesperson manager or employee dies. Best for Retail Businesses. The company is the beneficiary.

Business Interruption insurance is defined as under the Profit Form. Business interruption insurance coverage typically lists or describes the. The insurance covers the subsequent loss of income from the moment trading stops to when it is able to recommence.

A business that purchases life insurance on a key employee has purchased key person insurance. The income loss covered may be due to disaster-related closing of the business facility or due to the rebuilding process after a disaster. Flood damage typically requires separate coverage.

D It only applies to manufacturing businesses. Pays actual lost profits necessary continuing expenses and expenses over and above normal expenses incurred to stay in business C. Contingent Business Interruption CBI insurance reimburses a company for lost profits and other possible transferred risks such as necessary continuing expenses due to an insurable loss suffered by one or more of its suppliers or customers.

Business interruption insurance also known as business income insurance is a type of insurance that covers the loss of income that a business suffers after a disaster. The business interruptionincome insurance picks up the income lost resulting from the fire. Business Interruption Insurance covers loss of income resulting from a disaster scenario like a fire flood windstorm etc.

Other popular types of time element coverages include extra expense coverage which covers the additional costs of operating a business at the. What is business interruption coverage. Business interruption insurance is a type of insurance package that covers income following a disaster.

Future is a secondary burden of risk. If you have a Business Owners Protection Package check the co-insurance provisions. This includes income lost due to the temporary closing of a business facility in order to rebuild after a disaster.

This type of insurance differs from property insurance in that the latter only covers physical damage to the. Extraordinary expenses necessary to continue. Unlike traditional business interruption insurance.

The key employee is the policyowner and pays the premiums. Best for Professional Services. Business interruption insurance covers the loss of income that your business may suffer after a disaster.

A towncity centre location 2. A Until the damaged property has been restored and business reopens. Coverage Property Damage Business Interruption on an All Risks basis.

65000 sqft Retirement Investments Insurance Health Is your property in or adjacent to. Answers to Test Yourself. Pays agreed dollar hmit per day while object is not usable due to accident B.

The real purpose. Includes wind flood and earthquake coverage Machinery and Electrical Breakdown Perils Business Interruption extensions SuppliersCustomersUtilitiesDenial of Access - subject to certain constraints Using either a company or manuscript form policies. Insurance industry in India.

It can cover the extra expense of operating out of a temporary location. This income loss may be a result of physical damage and the resulting rebuilding process or it may be due to a disaster related closing of the business facility. This considers and covers the profits that would have been earned had the business been able to remain open.

Best for Restaurants. Consider Accounts Receivable and Valuable Papers coverage and Income Destruction insurance. Insurance Regulatory and Development Authority is the regulator for the.

A businessowners policy that covers a fire damaging your business personal property prevents you from operating your business as profitably as it was prior to the loss. Obtain Business Interruption Insurance.

When Does Business Interruption Insurance Coverage Stop Expert Commentary Irmi Com

Business Interruption Insurance Powerpoint Template Ppt Slides Sketchbubble

Business Interruption Insurance Powerpoint Template Ppt Slides Sketchbubble

Business Interruption Insurance Powerpoint Template Ppt Slides Sketchbubble

0 Response to "Which of the Following Best Describes Business Interruption Insurance"

Post a Comment